Latest NewsBusiness

Some states are seeking to restrict TikTok despite its use by governors

STOCK PHOTO Harrisburg, Pa. (AP) — POV: You’re on TikTok, and so is your governor — even as your Legislature considers banning the app from …

IRS claws back money given to businesses under fraud-ridden COVID-era tax credit program

New York (AP) — The IRS says it’s making progress with initiatives to claw back money improperly distributed under the Employee Retention Credit. The ERC …

Latest NewsTechnology

Florida casinos ask courts to stop online sports gambling off tribal lands

ORLANDO, Fla. (AP) — The state of Florida and the Seminole Tribe of Florida will be raking in hundreds of millions of dollars from online …

AI companies to report safety tests to US government

STOCK PHOTO WASHINGTON (AP) — The Biden administration will start implementing a new requirement for the developers of major artificial intelligence systems to disclose their …

Latest NewsHealth and Wellness

NFL, union approve new helmets for quarterbacks, linemen

Eight new position-specific helmets for quarterbacks and linemen have been approved by the NFL and the NFL Players Association. STOCK PHOTO Eight new position-specific helmets …

US wildfires are getting bigger prompting firefighting changes

STOCK PHOTO Prescott, Ariz. (AP) — It’s shaping up to be a long wildfire season, with Texas already seeing its largest blaze in recorded history …

Six stress reduction tips for Alzheimer’s caregivers

New York — Stress doesn’t just affect your mood—it can have long-term health impacts as well if you don’t take steps to manage it constructively. …

Latest NewsEducation

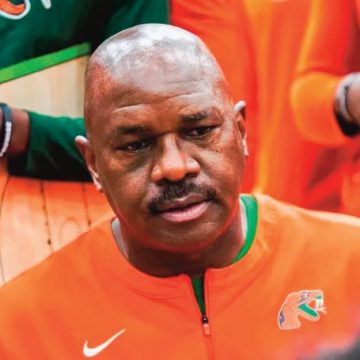

Investigation finds no bullying before suicide of top historically Black Missouri college leader

Antoinette Bonnie Candia-Bailey PHOTO COURTESY OF .HBCULEGGINGS.COM Columbia, Mo. (AP) — The president of a historically Black Missouri university has been reinstated after an independent …

Broward schools get metal detectors

Torey Alston, a member of the Broward County School Board pictured during his tenure as a Broward County commissioner, supports the added security. PHOTO COURTESY …

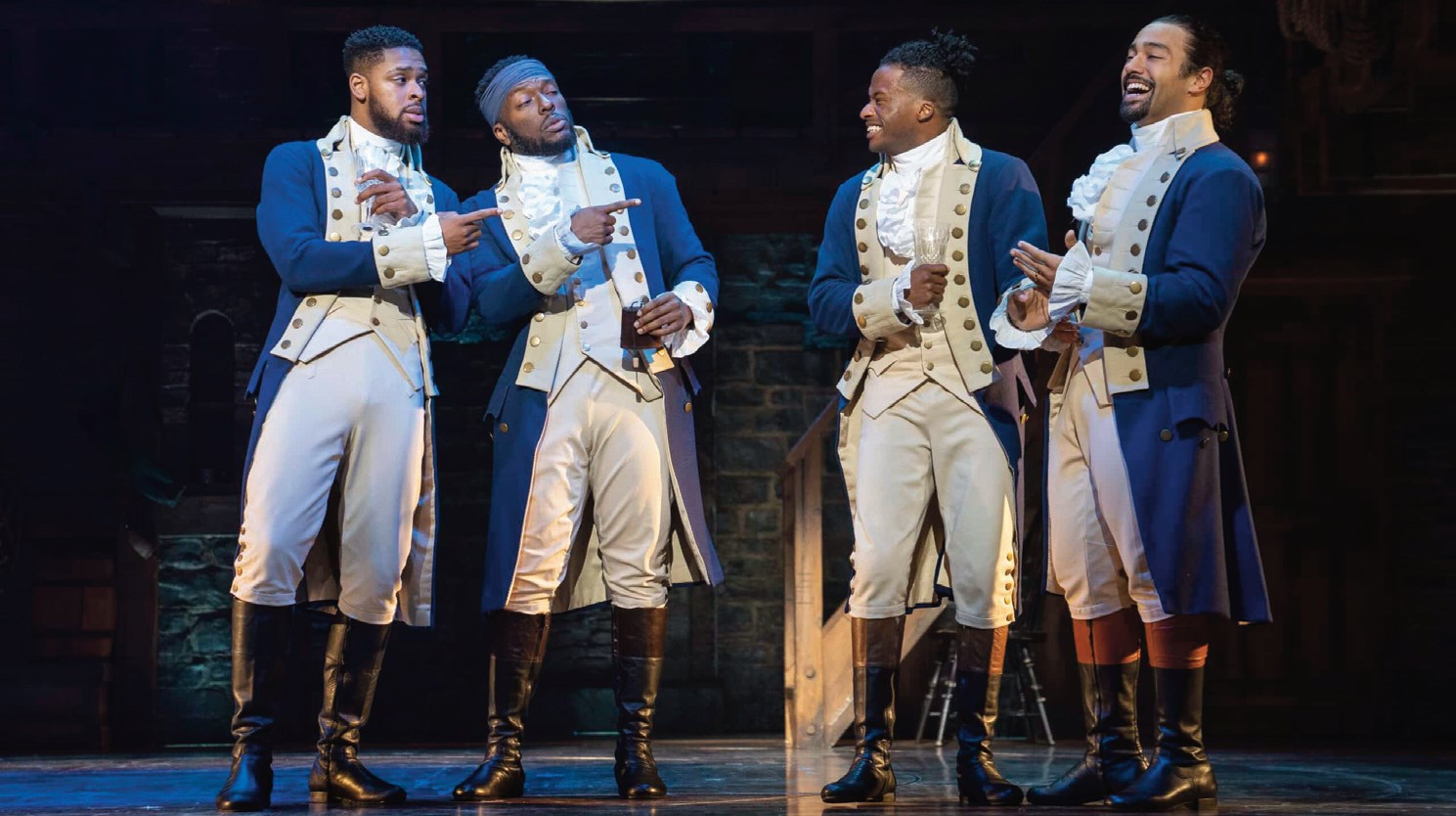

Celebrating HBCUs

MIAMI, Fla. – The Historic Society and Hip Rock Star recently wrapped up the Historically Black Colleges and Universities Conference (HBCUCon), an annual celebration of …

Latest NewsSports

Dawn Staley, South Carolina in good place to keep dynasty rolling, repeat as champions

DAWN STALEY: "She is winning the hearts, souls and minds of the next generation of powerful, exceptional leaders.” With most of the team – minus …

NFL mock draft: Bears take QB Caleb Williams at No. 1

The Chicago Bears passed up C.J. Stroud and Bryce Young last year because they had Justin Fields. Now, they’ve got a shot at Caleb Williams. …

Spring Sports Roundup Play Ball? More Black major leaguers may be on the way

NUMBERS REMAIN HISTORICALLY LOW: But Major League Baseball is working to get a new generation of African American stars such as Lee Allen Jr. into …