As Regional Administrator for Region IV of the U.S. Small Business Administration it’s my job, and the job of the agency, to try to help as many small business owners and entrepreneurs as possible access the capital they need to start or grow their business.

[optinlocker]We know we’ve made gains in expanding our programs, but there is still more to do to make sure SBA loans are available to every business owner who needs one to start or grow a business. Underserved communities in particular still have trouble accessing the capital they need to achieve their dreams.

When Administrator Maria Contreras-Sweet started on the job in April, she made clear that improving access to capital for the underserved would be a top priority. That’s why we’re pleased to announce that under her leadership, starting in July, we’ll be transforming our guarantee process to serve America’s small businesses—and the entrepreneurs behind them—better.

In an effort to streamline and simplify our loan application process, we’re streamlining our underwriting by making a total credit scoring model we’ve been testing and refining for over a decade available to all of our lending partners on loans of $350,000 or less. These changes will go into effect in the month of July.

The SBA total credit score combines an entrepreneur’s personal and business credit scores and makes it easier and less time-intensive for banks to do business with the SBA.This model is cost-reducing and credit-based. It ensures that risk characteristics – not socio-economic factors – determine who is deemed creditworthy.

Along with this simplification, we’re eliminating requirements for time-consuming analyses of a company’s cash flow on small loans under $350,000, a step that can delay loan decisions.

Additionally, at the beginning of this fiscal year in October, we set fees to zero on loans of $150,000 or less, another way to reduce the costs for lenders of making small-dollar loans. Why does this matter? Because often times, the smaller or newer the business, the smaller the loan. And as these businesses grow, they will come back for additional loans, creating jobs along the way. So encouraging lenders to make more small-dollar loans is good for the economy, it’s good for businesses, and it’s good for our communities.

These changes make sense. They are another step in our efforts to modernize our lending process and bring it up to pace with the high-tech era we live in. They will make it easier and less time-intensive for banks to do business with the SBA. We’re making these changes knowing that it will simplify and streamline the lending process, which will incentivize banks to make more small-dollar loans in order to get more loans into the hands of traditionally-underserved entrepreneurs.

We know that the key to a strong and lasting middle-class is opportunity for all. The President has made clear that we must grow our economy from the middle out. Key to that is access to the American Dream of starting and owning your own business. By making SBA loans easier and more affordable, more lenders will join our program, more small businesses will have access to our lending products, and more entrepreneurs will succeed.

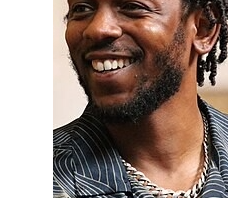

Cassius Butts is the regional administrator for the U.S. Small Business Administration. He was appointed by President Barack Obama in 2011. He is responsible for delivery of SBA programs in Alabama, Florida, Georgia, Kentucky, Mississippi, North Carolina, South Carolina, and Tennessee.

[/optinlocker]

No Comment