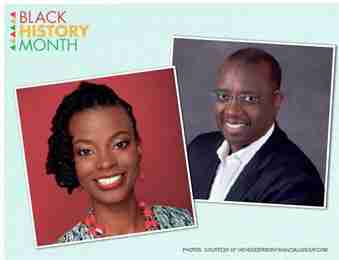

Hyacinth Henderson and her father, Robert Henderson Jr. of the Henderson Financial Group.

By MICHELLE HOLLINGER

MIAMI LAKES, Fla. – The Henderson Financial Group is an Investment Advisory and Financial Planning Firm. A full-service firm, the Miami-Lakes based company offers a range of services including, but not limited to budgeting and cash flow management, college planning and retirement planning, and managing investments such as stocks. Hyacinth Henderson, is managing director of the company launched by her father, Robert Henderson Jr. nearly 30 years ago. She shared a few tidbits regarding wealth building in the black community.

How does Henderson Financial help the community? For almost 30 years, The Henderson Financial Group has built a reputation for educating and empowering the community via various platforms. Our founder and President, Robert Henderson Jr., has a successful radio show where he offers a lot of free knowledge and information in an easy to digest, down-to-earth manner. The show airs every Saturday morning at 8 am on The Biz 880 am. We also offer free educational workshops and classes throughout the community.

What should black parents teach their children about money? One of the most important money lessons parents can teach their children is the importance of saving for a rainy day. In adult language, we call this “paying yourself first.”

The principal of not spending all your money is a basic yet fundamental principle. When people understand the importance of keeping some of their money for themselves, we can then further the conversation to include topics such as budgeting, investing, and wealth building. We gotta stop spending all our money first.

How can blacks increase the time their dollar circulates in the community? Buy black. Period. There’s a Black Owned alternative for all of your needs and most of your wants. Often, factors such as convenience, pricing, and habit are reasons why we don’t Buy Black. My recommendation is to start small. Commit to a small change and then grow from there.

What do you think is the biggest obstacle to blacks creatingwealth? The need for validation from others. People will argue the fact that we weren’t taught good financial habits when we were young. While that may be true, it’s now 2018, and we can learn anything we’d like to. We’re “free” now. The deeper issue is the need for validation. People purchase things and overspend as a weak attempt to prove “they got it.” When the focus shifts to using money as a tool (to make more money), we’ll start to make wealth generating decisions such as putting a deposit on a duplex instead of purchasing all the latest red bottoms.

What three things should blacks do to increase wealth in 2018? Live below your means, pay yourself first, and read more. The first two speak to cash flow management. We aren’t all meant to be entrepreneurs, and some people are satisfied with their current level of income. Understanding the difference between income and net worth means understanding that you have to be a good steward of what you currently have in order to be invited to the table of increase (abundance). Big Ma never had a six-figure income, yet her children and grands knew that she had a stash.

Granny understands the value in keeping her coins. Reading is essential because it broadens your horizons and expands your mind. You have to see beyond your current situation and be inspired to want more. Once you do this, you’ll slow down on the $300 belts and start asking questions like “”What is a trust fund?” or “What’s the difference between a value stock and a growth stock?.”

Are there any “old school” financial habits that blacks should recapture? That old school change jar is still a must. I use a 5-gallon water bottle. Sometimes I drop change inside, most times I drop bills inside.

No Comment