Caribbean Braids by Jasmin was opened out of necessity in 2004.

Caribbean Braids by Jasmin was opened out of necessity in 2004.

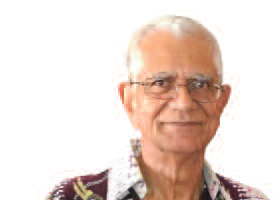

Jasmin Paul, the owner, had been out of work for two years.

“I knew I needed to start relying on my business [for income],” said Paul, then a mother of two teenagers.

Yet, although she had a cosmetology license for hair braiding, Paul had no training in how to run her own business.

Fortunately, she discovered The Peer Program, a business training and micro-lending program for small businesses, offered by Partners for Self-Employment, Inc. (PSE) in Miami.

The Peer Program teaches essential business concepts, such as how to create a business plan and how to develop marketing strategies. The program is divided into four levels, from a beginning theory class to an advanced class which provides hands-on business experience. When a participant advances to a certain level, they can apply for loans in increasingly larger amounts, up to $7500.

With funding for loans provided by the Small Business Administration and Miami-Dade County, Partners for Self-Employment is able to directly offer participants loans with interest rates of one percent per month.

For two years, Paul attended a class every week. “I used [the Peer Program] as a way to get a business education as if I was going to school,” said Paul. With the training and loans provided by the program, Paul was able to purchase a laptop, create a website and expand her business. Now, Paul says she is able to support herself with the profits of her business.

Established in 1993, the Partners for Self-Employment’s micro-lending program is for people without access to traditional funding from banks; usually people with low incomes and no higher education, immigrants and those with bad credit, explained Maria Coto, PSE executive director.

Coto also said that the program is open to anyone and currently has an estimated 200 to 300 participants.

Although 69-year-old James Lott had already built a successful 20-year-old bicycle repair business, he entered the Peer Program in 2005 for help with his three-year-old landscaping business in Homestead. Lott said that some of the benefits he received from the program were learning how to invest in his business, maintaining his customers, and networking with other business owners.

While 80 percent of the program still services traditionally marginalized communities, it is now accepting more people with higher education because of the economic downturn, said Coto.

In addition to The Peer Program, PSE also offers other programs to increase financial literacy and improve credit ratings. Older, more established businesses may qualify for the Expansion Program, which offers larger loans from $10,000 to $35,000; and an Individual Savings Program which matches two dollars for every one that a participant saves, up to $1000.

While funding and knowledge are important components for entrepreneurs, Coto said a greater service that the non-profit offers is intangible.

“A lot of people [are] more than anything, intimidated by the process [of starting a business and applying for loans],” said Coto, “A lot of [the] things that we do [are to] help people get through that.”

Kaila.Heard@Gmail.com

Photo courtesy of Sonia M. Terboss. Jasmin Paul

No Comment