WEST PALM BEACH — Hundreds of at-risk homeowners poured into the Palm Beach County Convention Center on Friday in hopes of saving their homes. HOPE NOW organized the homeownership preservation session to give residents a chance for a face-to-face meeting with mortgage servicers, lenders and housing counselors.

WEST PALM BEACH — Hundreds of at-risk homeowners poured into the Palm Beach County Convention Center on Friday in hopes of saving their homes. HOPE NOW organized the homeownership preservation session to give residents a chance for a face-to-face meeting with mortgage servicers, lenders and housing counselors.

“It gives us an opportunity to meet with the homeowner to go through all of their issues and, if they have income documentation, to offer some solutions,” said HOPE NOW director Faith Schwartz.

“We are looking for solutions to avoid foreclosure. That may be a [loan] modification. That may be a graceful exit if there are no qualifications or no income,” she said.

HOPE NOW is an industry-created alliance of mortgage servicers, investors and counselors working with homeowners to prevent foreclosures.

Schwartz estimates more than 1,000 families in the area need help with their mortgages.

“We work with the government and then go out to distressed areas so people who need help can meet with their servicers or lenders or a third-party counselor,” she said. “Palm Beach County has been hit hard. Florida as a state has been devastated by

foreclosures, unemployment issues and the recession.”

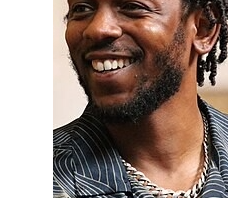

U.S. Reps. Ted Deutch, D-Boca Raton, Alcee Hastings, D-Miramar, and Allen West, R-Plantation, were among officials who showed up for the event.

Hastings said he thinks predatory practices were used and more can and should be done to help homeowners with their mortgages.

“The housing crisis has hurt every sector of our society. I believe it has hurt African Americans and Latinos… a great deal more than it has the general community,” Hastings said. “They could cut some from the principle balance or extend the interest, then many people would be able to stay in their homes.”

According to Deutch, maintaining homeownership is pivotal in turning the economy around.

“The government needs to recognize that if we want to be serious about making the economy better, we have to help people own their homes,” Deutch said. “We have to hold the servicers accountable. We have to make sure the lenders are doing the right thing.”

Deutch said he has been working with other members of Congress from Florida, as well as Arizona and California and other states that have been hit hard by the mortgage meltdown. They are trying to make sure that the Obama administration does everything possible to keep people in their homes and to make sure there is no fraud.

Ron Faris, president of Ocwen Financial Corp., primary sponsor of the Hope Now event, said mistakes were made with unsustainable loans that hurt the

consumer.

“There were definitely loans made to customers that probably in the long term were not sustainable for them to continue to make payments on,” Faris said.

“We’ve obviously been hurt, especially here in Florida, by the drop in housing prices. Many customers, although they might be able to afford their payments, their houses are significantly under water and it makes it difficult for them to want to continue on,” Faris added.

Schwartz of HOPE NOW said the decline in the prices of homes has not helped but that funds are available.

Out of a $7.5 billion fund from the Troubled Asset Relief Program (TARP), Florida has a billion dollars in its Hardest Hit Fund in the state treasury because of the high volume of foreclosures, she said.

“We think more of Florida’s Hardest Hit Fund should be used for those people who are unemployed,” Schwartz said. “[The state has] until 2017 to use those dollars but we think they should get it out sooner than later.”

Deutch said Florida residents need to make sure that their officials keep this issue front and center.

“This is may be the most important issue in South Florida. Homeowners and everyone affected by this needs to look to their members of Congress,” he said. “They need to write them. They need to write to the senators. They need to write to the White House.”

Deutch’s office will hold

a foreclosure prevention workshop on Sept. 17 in West Palm Beach.

Tips for avoiding foreclosure include calling the lender as soon as possible, contacting housing counselors and understanding what options are available.

Faris said many prospective buyers may avoid going into foreclosure by getting free housing counseling and preparing a budget before getting a loan and purchasing a new home.

Hastings described the HOPE NOW event and similar sessions around the nation as a great step forward but said what is needed is money.

“All of the people in this room bailed out the banks,” Hastings said, referring to the multi-billion-dollar federal bail out of struggling banks. “And yet the banks won’t be about the business of modifying these loans. If they do not, what we’re likely to see, if we have a ‘double-dip’ recession, is yet another crisis in housing. We will not as a nation recover until we restore a stable housing market in this country.”

IF YOU GO:

WHAT: Foreclosure prevention workshop

WHEN: Saturday, Sept. 17

WHERE: Mary Immaculate Catholic Church, 390 Sequoia Drive, South, West Palm Beach.

FOR MORE INFORMATION: Call Rep. Ted Deutch’s office at 561–988–6302.

Photo:Rep. Alcee Hastings

No Comment