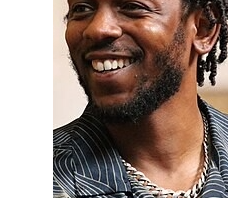

Congresswoman Maxine Waters, Ranking Member of the House Financial Services Committee

By Charlene Crowell

Over the past year, the Trump administration took a series of steps to weaken the Consumer Financial Protection Bureau (CFPB). Despite broad and bipartisan legislative and consumer support for the agency’s efforts that delivered transparency in financial transactions for consumers, these reversals also ended the kind of data collection, research, and investigations of consumer complaints that together held violators accountable, while making defrauded consumers financially whole.

Russell Vought, appointed to serve as both Secretary of the Office of Management and Budget and CFPB’s Acting Director, ordered the agency to close its offices early last year and then months later, chose not to request any funding from the Federal Reserve. Unlike many federal agencies subject to annual congressional appropriation, the CFPB receives its funding directly from the Federal Reserve. Caught up in this agency role reversal were an estimated 1,400 employees left uncertain whether their jobs could be retained or their collective mission continued.

But on December 30, a federal district judge issued a series of rulings that made clear that no administration could ignore or eliminate what Congress previously enacted into law, clearing the way for the Bureau to continue its important work.

In just two consumer categories – fees for late credit card payments and overdraft – an estimated $15 billion were taken from the pockets of consumers. Overdraft regulation that was set to take effect last year was scuttled at a cumulative consumer cost of $5 billion, while $32 monthly credit card late fees took another $10 billion from the pockets of everyday working people.

“By stopping virtually all work at the Consumer Bureau, President Trump is giving financial companies a green light to cheat working Americans out of their hard-earned money,” said Mike Calhoun, President of the Center for Responsible Lending.

Speaking directly to the administration’s refusal to request agency funding, Judge Amy Berman Jackson’s 32-page ruling wrote in part:

“The defendants’ interpretation of the Dodd-Frank Act is contrary to the text and intent of the statute and the way it has been consistently interpreted by both the Federal Reserve and the CFPB… [N]ot one penny of the funding needed to run the agency that has returned over $21 billion to American consumers comes from taxpayer dollars. The only new circumstance is the administration’s determination to eliminate an agency created by Congress with the stroke of pen, even while the matter is before the Court of Appeals.”

The ruling also itemized the duties CFPB “shall” perform:

- Reinstate all probationary and term employees terminated between February 10, 2025 and December 30, the date of this order, including but not limited to the Private Student Loan Ombudsman.

- No termination of any CFPB employee, except for cause related to the individual employee’s performance or conduct; nor issue any notice of reduction-in-force to any CFPB employee.

- Ensure that employees can perform their statutorily mandated functions, the defendants must provide them with either fully equipped office space, or permission to work remotely and laptop computers that are enabled to connect securely to the agency server.

- Ensure that the CFPB Office of Consumer Response continues to maintain a single, toll-free telephone number, a website, and a database for the centralized collection of consumer complaints regarding consumer financial products and services, and that it continues to monitor and respond to those complaints.

- Rescind all notices of contract termination issued on or after February 11, 2025, and they may not reinitiate the wholesale cancellation of contracts.

For Congresswoman Maxine Waters, Ranking Member of the House Financial Services Committee and a long-time CFPB champion, reacted to the court ruling saying, “Let’s be clear, the Trump Administration’s efforts to defund or dismantle this agency are not about fiscal responsibility, they are about shielding their allies on Wall Street and other powerful corporate interests from oversight while working families are left to fend for themselves.”

“At a time when families are already being squeezed by the Trump Administration’s reckless economic agenda, weakening the CFPB only makes it harder for people to keep up with rising costs, avoid financial abuse, and stay afloat”, Waters concluded.

No Comment