Hundreds of people streamed into a courtyard on Miami Dade College’s North Campus last weekend, hoping to get help hanging onto their homes. The Foreclosure Prevention Clinic, sponsored by Congressman Kendrick Meek, drew a crowd estimated at more than 800 people.

Hundreds of people streamed into a courtyard on Miami Dade College’s North Campus last weekend, hoping to get help hanging onto their homes. The Foreclosure Prevention Clinic, sponsored by Congressman Kendrick Meek, drew a crowd estimated at more than 800 people.

Lenders, as well as local housing agencies and representatives from the U.S. Department of Housing and Urban Development (HUD), Fannie Mae and Freddie Mac, were on hand April 12 to offer direct help to borrowers.

“I'm hoping to get assistance on how to deal with a foreclosure, because I’ve received the notice,’’ said 59-year-old homeowner Philipa, who did not wish to give her last name. “I’m just hoping they can advise me on what to do.”

Meek said the purpose of the clinic, the first sponsored by his district office (which annually conducts home-buying seminars titled, “With Ownership Wealth’’), is to give direct help to homeowners like Philipa.

“This workshop is probably one of the best attended events of its kind that I’ve seen in the 13 years I've been in office," Meek said. “I've never seen this kind of turnout of people with serious issues and problems who have nowhere else to go.’’

South Florida has been hit hard by the nationwide mortgage crisis, with 2,231 first-time foreclosures filed in Miami-Dade County alone during the first quarter of 2008, up 125 percent from the first quarter of 2007, according to real estate data website PropertyShark.com.

The website reported that the City of Miami had five times the foreclosure rate per household as Seattle, and nine times that of New York City during the first quarter of 2008.

Tables at the April 12 foreclosure clinic in Miami-Dade were lined with informational materials including fact sheets warning about refinance scams. Others explained the complex terminology used by lenders. Meek said the seminar was intended to offer direct help, in addition to information.

“A lot of people, if they had a note they couldn’t afford to pay, they just threw up their hands and said, ‘OK.’ They’re coming here and learning how they can save their homes.”

Loss prevention representatives from some 20 lenders including Bank of America, SunTrust, Washington Mutual and Wells Fargo offered one-on-one counseling to homeowners. “The college has WI-FI (wireless internet service) so we’re able to pull up the loans and give our clients direct information,’’ said Bank of America Community Impact Manager Katrina Wright.

“One woman came to us with two loans, and she wasn’t even in foreclosure. But she was able to consolidate the loans into one and make them more affordable.’’

HUD representatives at the clinic explained the federal agency’s “FHA Secure’’ program, which offers homeowners with adjustable-rate mortgages (“ARMs’’) the chance to refinance to a fixed-rate loan with an approved lender.

“People who are two months behind on their mortgages can refinance to 97 percent of their home value. Those who are three months behind can refinance at 90 percent,’’ said Armando Fana, a field officer for HUD. “And it’s not credit-score driven, so that makes it more accessible.’’

Lenders would be able to place a lien on the property to make up the difference between what the borrower owes and the value of the home and, to qualify, borrowers must have been current on their mortgages before their loan rates adjusted.

HUD estimates that 2.3 million ARMs will reset over the next two years, meaning many homeowners will be forced to make higher mortgage payments, or fall into foreclosure.

Homeowners whose lenders were not present at the clinic could avail themselves of counseling from county housing agencies like the Housing Finance

Authority of Miami-Dade County, or from non-profit agencies like the Miami-Dade Affordable Housing Foundation,

Inc., ACORN and NeighborWorks America.

Another non-profit, Legal Ser-vices of Greater Miami, Inc., was on hand to offer free legal advice to homeowners in trouble.

“I think the best part of this is that homeowners here can talk to a lender face-to-face,’’ said Legal Services attorney Carolina Lombardi.

The key, most of the counselors agreed, is for homeowners to act.

“For many people, if they simply contacted their lender, or a housing agency, it would make a difference,’’ said Fana, the HUD field officer.

Wright, the Bank of America community impact manager, agreed.

“It’s not necessarily someone who’s past due. You can get counseling and information that can prevent you from falling behind,’’ she said.

“This is needed help for the community,’’ said Marguens Noel, a 51-year-old homeowner and president of Union Diaspora, a community advocacy group.

“It's very helpful."

Lionel Roland, who also attended the event, agreed. “It’s a good thing for the congressman to put on. There was good information.’’

Beyond the April 12 event, Meek said the House Ways and Means committee would offer a bill designed to address the nationwide mortgage crisis.

The Housing Assistance Tax Act of 2008, introduced by U.S. Rep. Charlie Rangel (D-NY), would provide tax credits to first-time homebuyers, allow families to deduct part of their property taxes, and temporarily increase the low-income housing tax credit to give builders new incentives to build low-income housing.

For homeowners, the legislation would call for the issuance of $10 billion in new, tax-exempt bonds to refinance some sub-prime loans.

Meek said that once the House bill passes, a conference committee could hammer out a final bill within “several weeks.’’

The Senate last week passed a bill that drew criticism for providing $6 billion in emergency tax breaks for homebuilders and major Wall Street banks, but no direct help for homeowners.

The Senate bill calls for $4 billion in grants to allow local governments to buy foreclosed homes, and a $7,000 tax credit for individuals who do so.

Meek said action from Congress would come, “I hope soon and very soon. I see a lot of people here on the brink of needing that help right away.’’

The urgency of the situation wasn’t lost on attendees or counselors at the event.

“You can see by the turnout here there's a huge need for this kind of help in South Florida,’’ Fana said.

JoyAnnReid@Gmail.com

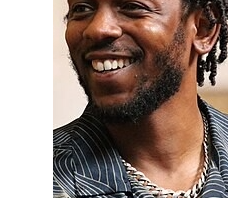

Photo: Congressman Kendrick Meek

No Comment