By MELINDA DESLATTE

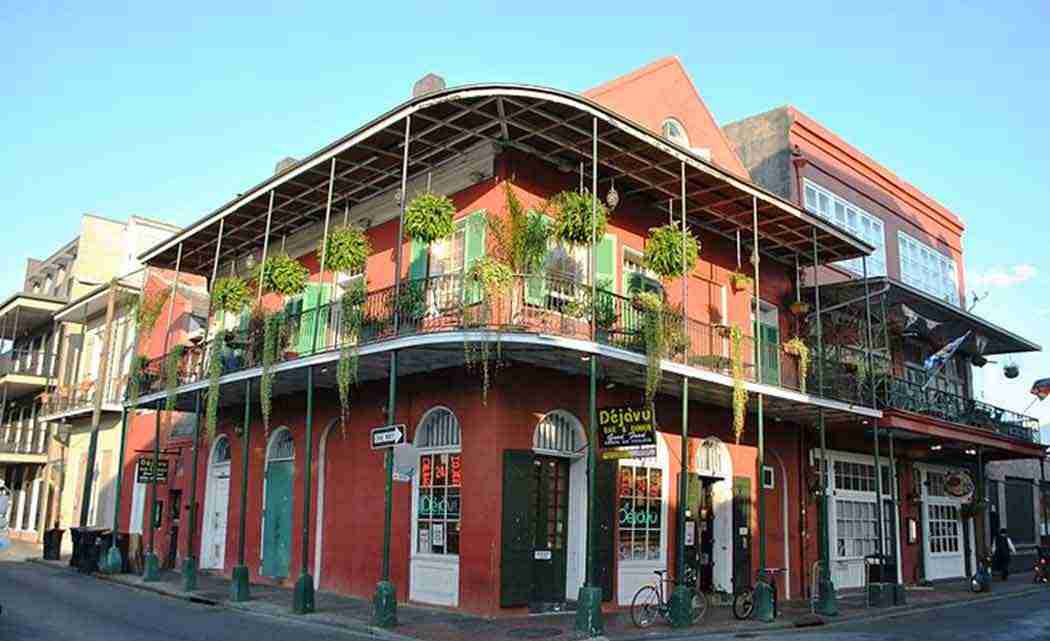

BATON ROUGE, La. (AP) _ Despite budget question marks and the collapse of a recent LSU bond sale, Louisiana borrowed $335 million Wednesday without running into problems with investors.

The state sold the general obligation bonds to low bidder Wells Fargo Bank, with the money slated to replenish the state’s construction project fund. The Bond Commission agreed to the sale without objection.

Louisiana’s financial adviser said the winning bid was in line with current market conditions, though the 3.3 interest rate was slightly higher than the state’s last general obligation bond sale in November, which had a 3 percent interest rate.

“We did a little worse than our last transaction,” said Renee Boicourt, with Lamont Financial Services Corp. “I think this is a very good result, and I think it’s consistent with the way the market’s been acting.”

Treasurer John Kennedy estimated the state will pay about $5 million more in interest costs than on the state’s last general obligation bond issue.

“Overall, I’m pleased. It could have been a lot worse, given our financial difficulties,” he said in a written statement.

The borrowing, to be paid off over decades with interest, was expected to keep work humming on state-financed construction through February. The dollars will go into a state escrow account that pumps money into state building repairs, economic development projects, road work and lawmakers’ local projects.

Uncertainty about how the state will close a $1.6 billion budget shortfall in the fiscal year that begins July 1 had caused worries the state might face less favorable terms for the bond sale. Lawmakers are currently negotiating over whether to make tax changes or deep cuts to balance next year’s budget.

LSU stopped nearly $115 million in planned borrowing two weeks ago as investors pulled out of the deal amid concerns over the university’s financial instability. The university is threatened with cuts of up to 80 percent of its state financing in the upcoming budget year.

But debt payments are one of the first draws on the state treasury, giving them a higher level of protection under Louisiana’s constitution than many other areas of state spending.

Kennedy said the state disclosed its budget uncertainties in the paperwork for possible investors. He said without the new borrowing, one construction account was slated to run out of money within 10 days.

At the rate the state is spending money, Boicourt has warned that Louisiana could face cash flow problems for projects next year, because of borrowing limits tied to the state’s debt ceiling.

No Comment