WASHINGTON (AP) _ President Barack Obama intends to nominate veteran Rep. Melvin Watt to head the Federal Housing Finance Agency, the government regulator that oversees lending giants Fannie Mae and Freddie Mac. He also has chosen a former telecommunications lobbyist to head the Federal Communications Commission, the White House said.

WASHINGTON (AP) _ President Barack Obama intends to nominate veteran Rep. Melvin Watt to head the Federal Housing Finance Agency, the government regulator that oversees lending giants Fannie Mae and Freddie Mac. He also has chosen a former telecommunications lobbyist to head the Federal Communications Commission, the White House said.

Watt, a North Carolina Democrat who has been in Congress for 20 years, would replace Edward DeMarco, an appointee of Republican President George W. Bush, who has been a target of housing advocates, liberal groups and Democratic lawmakers.

Obama also has settled on Tom Wheeler, one of his top campaign fundraisers, to become the country's top telecommunications regulator. The president is expected to name FCC Commissioner Mignon Clyburn to serve as acting chairwoman.

Senate confirmation is required for both posts.

White House press secretary Jay Carney said Wednesday that Obama believes Watt and Wheeler both are excellent candidates for the positions he's nominating them for.

Carney noted Watt's two decades in the House, including his long service as the Financial Services Committee and his "proven track record of fighting to reign in deceptive mortgage lenders'' and his advocacy for the "little guy.''

"That's the kind of experience the president wants in this position,'' Carney said.

Wheeler raised more than $500,000 for Obama's re-election effort, according to data provided by the campaign. He also contributed more than $17,000 combined to Obama's re-election and to several Senate campaigns, including Virginia Democratic Sen. Tim Kaine's successful effort.

Wheeler is former head of the Cellular Telecommunications & Internet Association and the National Cable Television Association. Since 2005, he has been a venture capitalist at Core Capital Partners. Wheeler would replace Julius Genachowski, who announced in March he would be stepping down from the FCC.

Obama was scheduled to announce the nominations Wednesday afternoon at the White House.

Watt's nomination comes at a crucial time for Fannie Mae and Freddie Mac, two government-controlled mortgage-finance enterprises. The government rescued the companies at the height of the financial crisis in September 2008 as they teetered near collapse from losses on mortgage loans gone bad.

Taxpayers have spent about $170 billion to rescue the companies. So far, they have repaid $55.2 billion.

Fannie and Freddie together own or guarantee about half of all U.S. mortgages, or nearly 31 million home loans. Those loans are worth more than $5 trillion. Along with other federal agencies, they back roughly 90 percent of new mortgages.

The nomination comes as the housing industry is making a comeback. Home prices are up, foreclosures are down and housing construction is on the rise. Moreover, Fannie Mae had its biggest yearly profit last year, earning $17.2 billion.

Watt, a senior member of the House Financial Services Committee and former chairman of the Congressional Black Caucus, played an influential role in the passage of a financial regulatory overhaul in 2010. That legislation, however, did not address the fate of the major mortgage lenders, an issue likely to come up during Obama's second term.

Watt represents the Charlotte area, home base of behemoth Bank of America Corp. He becomes yet another high-profile African-American and the second North Carolinian nominated by Obama in three days to a top government post. On Monday, Obama nominated Anthony Foxx, mayor of Charlotte, to head the Transportation Department.

Watt, who has a consistently liberal voting record, is expected to face Republican opposition to his confirmation and Sen. Bob Corker, R-Tenn., was among the first to express disappointment.

The White House was already lining up supporters who might hold some sway with GOP senators.

"This gives new meaning to the adage that the fox is guarding the hen house,'' Corker, a member of the Senate Banking, Housing and Urban Affairs Committee, said in a written statement. "The debate around his nomination will illuminate for all Americans why Fannie and Freddie failed so miserably.''

Corker added that the administration should “explicitly lay out'' its plans for dissolving Fannie and Freddie before anyone is considered for the FHFA's top job.

The administration put forward such a plan in 2011, with the goal of shrinking the government's role in the mortgage finance system. But Congress has yet to decide how much to reduce the government's role.

Erskine Bowles, a fellow North Carolinian and former White House chief of staff under President Bill Clinton, praised Watt as a first-rate selection. Both were classmates at the University of North Carolina at Chapel Hill. Bowles, the Democrat in a debt-tackling partnership with former Republican Sen. Alan Simpson of Wyoming, said Watt brings "a bright mind, great work habits and an understanding of how Washington works to the job.''

Hugh McColl, former Bank of America chairman and CEO, also welcomed Watt's nomination. McColl said he has known Watt for four decades, first meeting him through his brother-in-law, former Rep. John Spratt, D-S.C., who attended Yale Law School at the same time as Watt.

"What he brings to everything, doesn't matter the subject, is an open mind,'' McColl said. "He has clarity of thought.''

Charlotte is a major banking center, and the top donors to Watt's political campaigns over the years have been bank political action committees and bank officials and employees.

His nomination comes nearly a year after DeMarco, who has been acting director, stood by a decision to bar Fannie and Freddie from reducing principal for borrowers at risk of foreclosure, resisting pressure from the administration. DeMarco long has opposed allowing the mortgage giants to offer principal reduction.

In March, attorneys general from nine states, led by Democrats Eric Schneiderman of New York and Martha Coakley of Massachusetts, sent Obama a letter saying that Fannie and Freddie under DeMarco have been a “direct impediment to our economic recovery.''

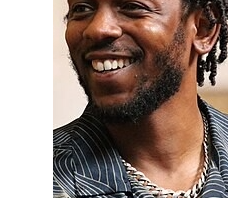

*Pictured above is former congressman Mel Watt.

No Comment